You’re probably wondering, does Oregon offer a tax credit for solar panels? Well, let me shed some light on the subject for you. In this informative piece, we will explore the ins and outs of Oregon’s solar incentives, including any tax credits that might be available to you. So sit back, relax, and let’s look into the world of solar panel tax credits in Oregon!

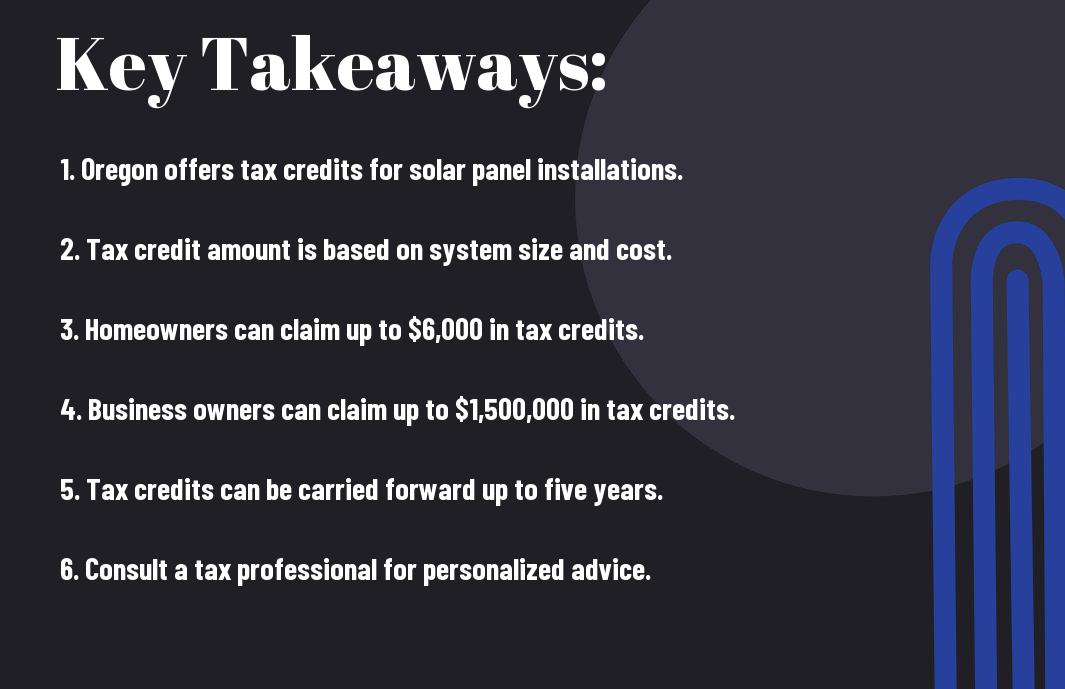

Key Takeaways:

- Oregon offers a Residential Energy Tax Credit (RETC) for installing solar panels. This credit can significantly reduce the cost of installing a solar energy system for homeowners in Oregon.

- The RETC allows homeowners to claim 50% of eligible costs, up to $6,000. This can make it more affordable for homeowners to invest in renewable energy and reduce their carbon footprint.

- It’s important to check with the Oregon Department of Energy for current information on the RETC program. The program may have specific requirements and deadlines that must be met to qualify for this tax credit.

The Basics of Solar Panels in Oregon

What are Solar Panels?

A vital part of many Oregonians’ sustainability efforts, solar panels are devices that convert sunlight into electricity. These panels, also known as photovoltaic (PV) modules, are typically mounted on rooftops to capture the maximum amount of sunlight throughout the day. The sunlight is then converted into direct current (DC) electricity, which is transformed into alternating current (AC) electricity by an inverter for use in your home.

Why Go Solar in Oregon?

Solar power offers numerous benefits in Oregon. Aside from reducing your carbon footprint and contributing to a cleaner environment, installing solar panels can significantly lower your electricity bills. In Oregon, where the state enjoys abundant sunshine for a significant part of the year, harnessing solar energy is a smart choice for both your pocket and the planet.

To truly take advantage of Oregon’s solar potential, outfitting your home with solar panels not only helps in reducing your dependence on traditional energy sources but also adds value to your property. In a state that values sustainability and renewable energy, going solar in Oregon is a sure way to make a positive impact while enjoying the financial benefits of clean energy.

Oregon’s Tax Credit Policy

Overview of the Tax Credit

Clearly, understanding Oregon’s tax credit policy is crucial if you are considering investing in solar panels. Oregon offers a Residential Energy Tax Credit (RETC) for individuals who install solar energy systems on their property. This credit can help offset some of the costs associated with going solar, making it a more attractive option for many homeowners.

Eligibility Requirements

Policy: To be eligible for the RETC in Oregon, you must be a resident of the state and own the property on which the solar panels are installed. Additionally, the solar energy system you install must meet certain requirements set by the state to qualify for the tax credit.

Credit: The amount of the tax credit you can receive in Oregon is based on the cost of the solar energy system you install. Typically, the credit can cover a percentage of the total cost, making it a valuable incentive for those looking to make their homes more environmentally friendly and energy-efficient.

How to Claim the Credit

The process of claiming the tax credit for solar panels in Oregon is relatively straightforward. The Oregon Department of Energy oversees the application process, and you will need to submit the necessary documentation to prove your eligibility and the cost of the solar energy system. Once approved, you can then claim the tax credit on your state income tax return.

Claim: It’s important to keep all receipts and documentation related to the installation of your solar panels to ensure a smooth and successful claim process. By taking advantage of Oregon’s tax credit for solar panels, you can not only save money on your taxes but also contribute to a more sustainable future for the environment.

Benefits of the Tax Credit

Reduced Energy Costs

On top of the environmental benefits, installing solar panels in your Oregon home can significantly reduce your energy costs. By harnessing the power of the sun, you can generate your electricity, decreasing your reliance on the grid. This means lower monthly energy bills for you.

Increased Property Value

For homeowners in Oregon, investing in solar panels can also lead to increased property value. Properties equipped with solar panels are often more attractive to buyers due to the long-term cost savings they provide. A solar energy system is seen as a valuable addition that can set your property apart from others on the market.

The value of your home can increase significantly with the addition of solar panels. Studies have shown that properties with solar installations not only sell faster but also command higher selling prices compared to homes without them. So, by taking advantage of the tax credit to install solar panels, you are not only saving money on energy costs but also making a smart investment in your property.

Environmental Impact

The use of solar panels in Oregon helps reduce the reliance on fossil fuels for electricity generation. By generating clean, renewable energy from the sun, you are contributing to a healthier environment for everyone. Solar power produces no greenhouse gas emissions, helping to combat climate change and reduce air pollution.

The environmental impact of installing solar panels goes beyond your individual property. On a larger scale, widespread adoption of solar energy in Oregon can help the state move towards a more sustainable and environmentally friendly energy system. By choosing solar power, you are playing a part in creating a greener future for generations to come.

How the Tax Credit Works

Calculation of the Credit

Unlike other states that offer a flat rate tax credit for solar panels, Oregon’s tax credit for solar panels is calculated based on the cost of your system. With Oregon’s incentive program, you can receive a credit worth up to 50% of the total cost of your solar panel installation, capped at a maximum credit amount determined by the state. This means the more you invest in your solar panel system, the higher your tax credit will be.

Filing Requirements

Calculation of the credit is done by considering various factors such as the size of your solar panel system, its efficiency rating, and the total cost of installation. To claim the tax credit for solar panels in Oregon, you must fill out the appropriate forms when you file your state taxes. Keep all receipts and documentation related to your solar panel installation to substantiate your claim.

Requirements for filing the tax credit for solar panels in Oregon include providing proof of purchase and installation, as well as the necessary paperwork to demonstrate that your system meets the state’s requirements for efficiency and eligibility. Be sure to consult a tax professional or the Oregon Department of Energy for guidance on the specific documentation needed for claiming the credit.

Deadline for Claiming the Credit

The deadline for claiming the tax credit for solar panels in Oregon is the last day of the tax year in which the system was installed. This means that if you installed your solar panel system in 2021, you must claim the tax credit on your 2021 state tax return. Failing to claim the credit within the specified timeframe may result in forfeiting the opportunity to receive the tax incentive.

Claiming the tax credit for solar panels is a beneficial way to offset the initial investment of installing a clean energy system in your home. By taking advantage of Oregon’s tax credit program, you can not only reduce your tax liability but also contribute to a more sustainable future for the environment.

Comparing Oregon’s Tax Credit to Other States

Not all states offer tax credits for solar panels, and Oregon is fortunate to be one of the states that do. Let’s compare Oregon’s tax credit with other states to see how it stacks up.

National Average of Solar Panel Costs

Oregon’s Competitive Advantage

Oregon’s tax credit for solar panels is a significant advantage compared to other states, as it helps offset the initial costs of installation. This credit can make solar energy more accessible and affordable for homeowners in Oregon, encouraging more people to make the switch to renewable energy sources.

Other States with Similar Tax Credits

Credit

Other states that offer similar tax credits for solar panels often have strict eligibility requirements or lower credit amounts. Oregon’s tax credit is relatively generous and available to a broader range of homeowners, making it a more attractive incentive for investing in solar energy.

Another benefit of Oregon’s tax credit is that it can be combined with federal incentives, further reducing the overall cost of installing solar panels. This makes going solar even more financially feasible for Oregon residents, compared to states with less favorable incentives.

Common Misconceptions About the Tax Credit

Debunking the “Too Expensive” Myth

Your first misconception about the tax credit for solar panels may be that it is too expensive. However, the initial cost of installing solar panels can be offset by the tax credit offered by the state of Oregon. This credit can significantly reduce the overall cost of your solar panel system, making it a more affordable and sustainable option for your home.

Addressing the “Complexity” Concern

To address the concern of complexity surrounding the tax credit for solar panels, it’s vital to understand that the process is relatively straightforward. You can consult with a tax professional or your solar panel provider to navigate the application process smoothly. With their guidance, you can take advantage of the tax credit without any unnecessary stress or confusion.

Additionally, the state of Oregon offers resources and support to help homeowners understand and apply for the tax credit. By taking advantage of these resources, you can ensure a hassle-free experience while benefiting from the financial incentives of solar panel installation.

Clarifying the “Limited Availability” Rumor

Debunking the myth about the limited availability of the tax credit for solar panels is crucial. While it’s true that tax credits can vary in availability and amount, Oregon currently offers incentives for renewable energy investments, including solar panels. By staying informed about the current policies and deadlines, you can maximize your chances of qualifying for the tax credit and reaping its benefits for your home.

Myth: Understanding the eligibility criteria and staying updated on any changes to the tax credit program can help you make informed decisions about installing solar panels and taking advantage of the financial incentives provided by the state of Oregon.

To wrap up

The decision to invest in solar panels for your Oregon home can be a smart one for both the environment and your wallet. Unfortunately, Oregon does not currently offer a state tax credit for solar panels. However, there are still federal tax incentives and other financial benefits available to help offset the initial cost and make solar energy a more accessible option for you. With the potential for long-term savings on your energy bills and a reduced carbon footprint, going solar in Oregon can still be a worthwhile investment.

Q: Does Oregon offer a tax credit for solar panels?

A: Yes, Oregon offers a Residential Energy Tax Credit (RETC) for the installation of solar energy systems. This tax credit can help offset the cost of installing solar panels on your property.

Q: How much is the tax credit for solar panels in Oregon?

A: The tax credit amount in Oregon varies depending on the size of the solar energy system installed. The maximum credit amount allowed is $6,000 for residential systems.

Q: Are there any eligibility requirements to qualify for the solar panel tax credit in Oregon?

A: To be eligible for the solar panel tax credit in Oregon, the system must be installed by a licensed contractor, meet specific technical requirements, and be connected to the grid. Additionally, the taxpayer must be the owner of the property where the system is installed.